Call or Text for a free consultation on Medicare Plan

My Medicare Blog

The Ultimate medicare guide

There are many ways of getting your Medicare benefit. The simplest way to get it directly from Medicare. When you turn 65 you will receive your Medicare Part A automatically, then you can sign up for part B, and you are done. Medicare A, in simplest terms, covers things inside the hospital and Medicare part B covers medical expenses incurred outside of a hospital setting. For more information about what is covered and what is not please visit medicare.gov. In this blog, I will discuss the other things to consider while trying to decide whether getting your benefits directly from Medicare or some other ways.

Medicare, as you might already know, is not free. Medicare A has deductible, Medicare B has deductible and coinsurance (20%) after the deductible on the top of monthly premiums. Between A & B, prescription drugs are not covered, for which you need to buy Part D. Part D, has deductible, initial coverage, then coverage gap and catastrophic coverage. For a more detailed overview of Part D please view medicare.gov.

To reduce the out of pocket expenses which comes with Medicare, some people by Medicare supplements plans also known as Medigap policies. Medicare supplement plans as the name suggest pays for expenses not covered by Medicare up to various extent depending on the plans you chose. One thing worth mentioning here, Medigap plans do not pay for prescription drugs.

Finally, another way of getting Medicare benefit is through, Medicare advantage plans. Medicare Advantage plans are administered by private insurance companies, through a governmental contract. As per the contract, these plans are required to offer benefits, at least equivalent to what is offered by Medicare. In reality, due to competition and innovation, many plans add a lot of incentives above and beyond what is required by Medicare.

Here are the 5 things you should consider while making your decision about Medicare Benefit

1 Costs: As discussed above, premiums, deductibles, co-insurances are your responsibility. With original Medicare, there is no limit of your out of pocket costs unless you have a supplement plan. Advantage plans have an annual maximum out of pocket limit.

- Costs can be fixed or variable. A fixed cost is something that does not change with utilization of services, for example, you pay the same premium for Medicare part B throughout the year and that does not change if you consume more or less of health care.

- The variable cost of healthcare varies with utilization. Medicare part B coinsurance is an example of variable cost. The more you use, the more you pay and vice versa.

2 Coverage: How does the plan fit your needs? Medicare does not pay for vision, hearing, or dental. If you foresee needing any of these services you should look for coverage outside of original Medicare.

3 Prescription Drugs: Drugs are only covered by stand-alone part D or with MAPD (Medicare Advantage with Part D) plans.

4 Doctor and hospital choice: When you have an Advantage plan you have to stick with a group of doctors and hospitals and often you might have to choose a primary care provider. Not with original Medicare. If you have original Medicare, you can go to any doctor or hospital that accepts Medicare payments, and most of them do.

5 Travel: Medicare advantage plans offer only emergency Medical care while travelling out of the area, with the exception of some plans where you can carry your coverage with you.

But Medicare does not cover (even emergencies) if you are travelling outside the United States (except if you are travelling from or to Alaska by land and need emergency care in Canada). Some supplement plans do offer up to $50,000 for emergency care for international emergencies. Many advantage plans have an $100,000 limit per year for international emergencies. Keep in mind that none of the Medicare-related plans will cover for non-emergency care out of the country.

The following scoring table will help you make an informed decision about choosing Medicare benefit. Please click here to print this table.

Building Relationships, Helping Meaningful Changes

Are you new to medicare?

Check out this great video on Medicare

Decisions to be Made for Medicare

Medicare Decision Guide

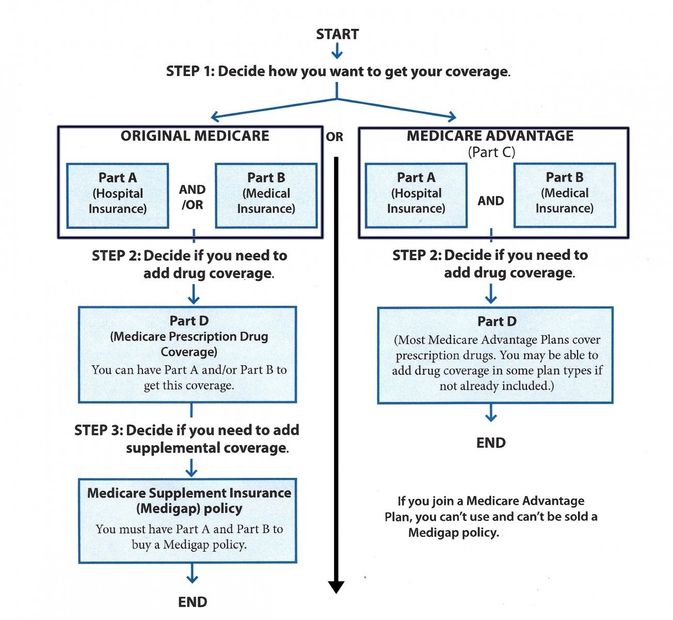

When you get Medicare you have to make a few primary decisions on how you want to receive your benefits. The above flowchart explains the decisions involved.

Original Medicare

Medicare is the federal health insurance program for:

People who are 65 or older,

Certain younger people with disabilities,

People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

Medicare Advantage Plans

Medicare Advantage Plans (also known as Part C) are a type of Medicare health insurance plan offered by a private company that contracts with Medicare to provide all your Part A and Part B benefits. Most Medicare Advantage Plans also offer prescription drug coverage. If you’re enrolled in a Medicare Advantage Plan, most Medicare services are covered through the plan.

Medicare Supplement Plans

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement (Medigap) health insurance policy can help pay some of the remaining health care costs, like:

Co-payments, Coinsurance, Deductibles